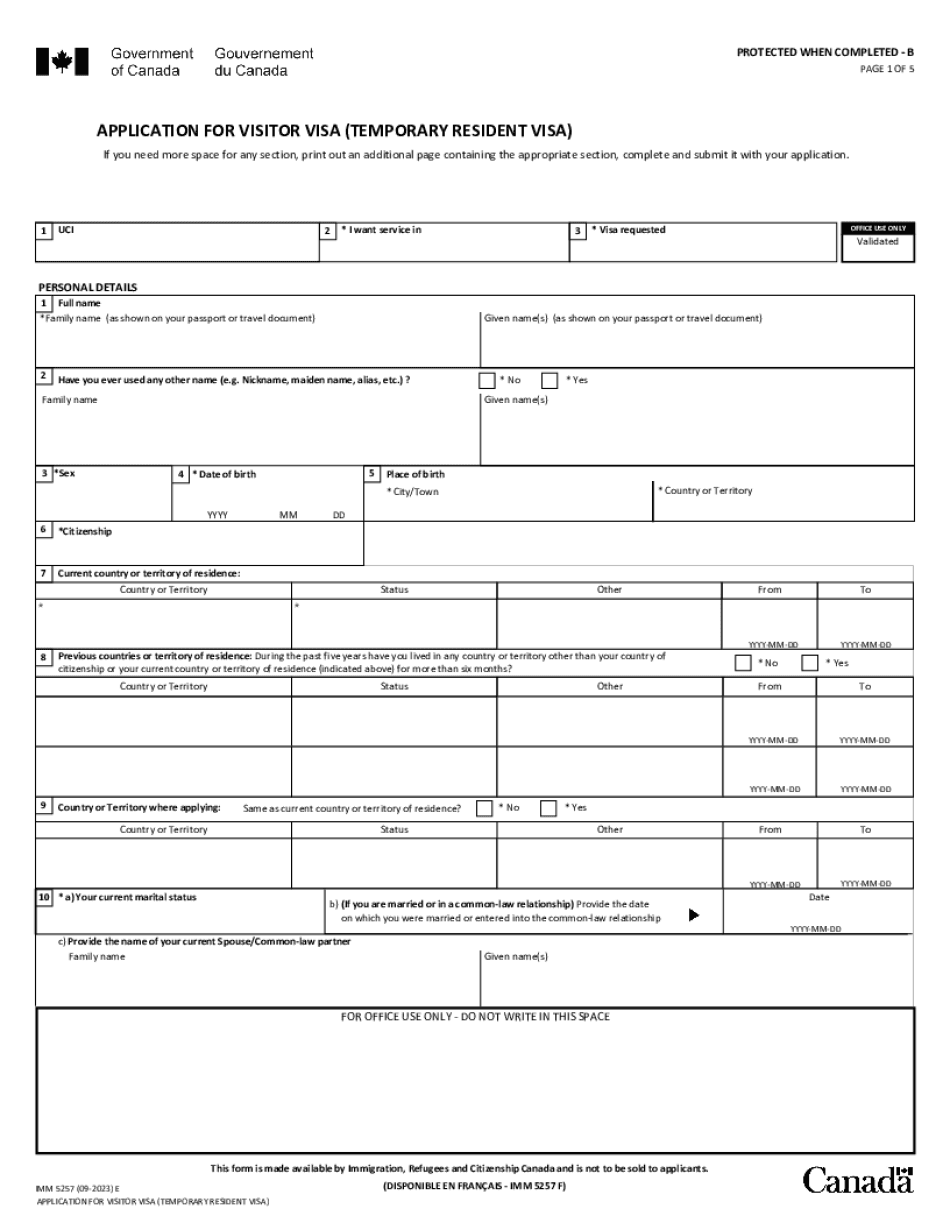

Hello everyone welcome back to my YouTube channel if you're new here thank you so much for tuning in if you're an oldie thank you so much for always sticking with me my name is Adora uzoma I'm a Nigerian Canadian based in London Ontario Canada and I love to create content about how you can come to Canada as a new immigrant and how you can navigate life here so in today's video we're going to be looking at how you can fill out the IMM 5257e form now this form is called the application for Vista Visa in bracket here it says temporary resident Visa so you might be wondering who is a temporary resident in Canada so a temporary resident Visa is also referred to as a visitors visa and an official document issued by a Canadian Visa office that is placed in your passports to show that you have met the requirements for admission to Canada as a temporary residence the temporary residence can either be a visitor a student or a worker these types of people fall under temporary residence in Canada okay so we're going to be I'm going to be showing you how you can fill out this form correctly I have already pre-filled it before starting this video so that's just gonna be a seamless video for you guys to follow through okay so first things first what do we have here the first thing we have here is your UCI number which is also called the unique client identifier if you don't have that number that's okay you can find this UCI number on in all your immigration documents uh if you don't have this is your first time then obviously you don't have a UCI number okay so the second...

PDF editing your way

Complete or edit your imm 5257 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export imm5257e directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your imm 5257 form 2021 pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your canada tourist visa by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Imm 5257E

About Form Imm 5257E

Form IMM 5257E, also known as the Application for Temporary Resident Visa, is a Canadian immigration form that is used by individuals who are not Canadian citizens or permanent residents and want to enter Canada for temporary purposes, such as tourism, visiting family or friends, or conducting business affairs. This form is required by individuals who are citizens of countries that are visa-exempt or do not have a visa agreement with Canada, as they need to obtain a temporary resident visa (TRV) to enter the country. The form collects personal information, travel details, and background information to assess the eligibility of the applicant for a TRV. It is an essential document for individuals planning a short-term visit to Canada who need to obtain a visa prior to their arrival.

What Is Imm5257?

Imm 5257E Form is necessary while applying for a visa to visit Canada. It is important to figure out whether you need to fill out this form or not. It depends on your Country of Residence. For some countries the Electronic Travel Authorization is quiet enough.

In general, this form is used to disclose any information connected with applicant’s war crimes, participation in criminal and political groups, violent actions and so on.

Preparing this document requires collecting some important documentation. Check the whole list to avoid the delay and denial of the application.

How to fill out Imm 5257E?

This form may be created when needed and doesn’t have any particular due date.

Pay attention to the points below to have an idea what to write in the blank.

- In case, you are traveling together with the whole family all the members over 18 years old must complete this application.

- Pryour personal data: full name, age, gender, address, indicate your job etc.

- Put a current date.

- Sign the document.

After the completion of the Imm 5257E review it to avoid errors and make changes until it’s too late. It is possible to print the application and bring it personally or send it directly to your local Canadian Visa office.

Online solutions help you to organize your document management and strengthen the productivity of the workflow. Carry out the short manual in an effort to total Form MM 5257E, keep away from errors and furnish it within a timely way:

How to complete a Imm 5257?

- On the web site when using the kind, simply click Initiate Now and go for the editor.

- Use the clues to fill out the related fields.

- Include your individual info and call knowledge.

- Make convinced that you simply enter appropriate details and numbers in correct fields.

- Carefully look at the subject material within the type also as grammar and spelling.

- Refer that can help part for those who have any problems or tackle our Support workforce.

- Put an digital signature on the Form MM 5257E when using the guidance of Signal Resource.

- Once the shape is finished, press Completed.

- Distribute the completely ready type via e-mail or fax, print it out or help you save on your own device.

PDF editor makes it possible for you to definitely make variations towards your Form MM 5257E from any on-line related equipment, customize it as outlined by your requirements, indication it electronically and distribute in several strategies.

What people say about us

Take full advantage of an expert form-filler

Video instructions and help with filling out and completing Form Imm 5257E